There has been no other convergence of pressures upon B2B manufacturing and distribution in the last century. In addition to increasing operational costs and the volatility of demand patterns, there has emerged a new demographic of buyers demanding a seamless experience akin to Amazon.

While outside forces such as rising operational costs and volatile demand patterns have placed unprecedented pressure upon B2B profit margins, the greatest threat to profit in many B2B organizations remains hidden inside the organization itself – within the operational practices of the sales floor. Specifically, the greatest threat is the reliance upon manual efforts to complete the highest volume transaction within the company – the reorder.

It is estimated that between 60% to 80% of all sales volume in B2B organizations comes from repeat orders. However, when repeat orders are processed via telephone, email or fax, they become what we refer to as the “silent killer.” While these repeat orders may seem innocent, they quietly undermine profitability through increased working capital requirements, longer order cycle times and human error.

As a response to the “silent killer,” innovative B2B executives are developing a “digital reorder blueprint” to eliminate cost-to-serve and engineer higher customer lifetime value (CLTV). The “blueprint” is not a conceptual framework – it is a well-defined, sequential approach to automation that will deliver improved profitability.

Below is the detailed, four-phase implementation 90-day transformation timeline plan based on actual industry transformations.

Phase 1: Map the Leaks (The Operational Audit)

The first phase in the development of a digital reorder blueprint involves conducting a forensic review of the existing “manual order labyrinth.”

The manual order labyrinth refers to the processes used to receive, enter, manage and fulfill a manual order. Often, we confuse activity (i.e., a busy sales floor with phones ringing) with productivity. Activity appears productive; however, if the activity is a series of routine reorders, it is actually a drain on profit.

Therefore, in order to assess the real-world cost of the manual order labyrinth, the organization needs to document the steps involved in completing a single manual order:

1. The Intake Cost: An order is received via telephone, email or fax. When the CSR is available to answer the call, they respond. When unavailable, the missed opportunity represents lost revenue.

2. The Lookup Tax: Once contacted, the CSR must use the ERP system to locate the product being ordered. Each product must be located individually using a SKU (stock keeping unit), which can take anywhere from 5 to 10 minutes per item. This represents a fixed cost in terms of labor hours.

3. The Entry Risk: The CSR must manually enter each line item into the terminal. Historically, this is the point at which critical failures occur. Research indicates that approximately 80% of order processing errors are caused by the manual entry of data. Therefore, a “B” entered incorrectly may be interpreted as an “8” resulting in the shipment of an incorrect product.

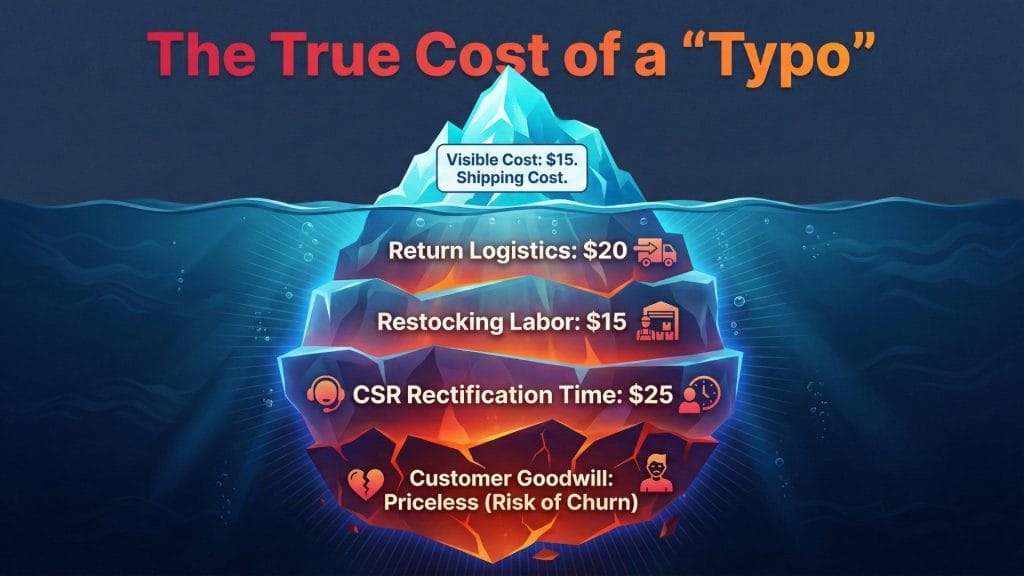

4. The Rectification Penalty: Once the error is identified, the cost associated with rectifying the mistake is typically three times greater than the original price of the product. The company absorbs the cost of returning the product, expediting the replacement product and the labor to process the returned product. Based on industry estimates, the average cost to correct a single error may exceed $75, excluding the negative impact on customer satisfaction.

5. The Inquiry Drain: Approximately two days after the order was placed, the customer contacts the CSR to inquire about the status of the order. The CSR must again spend 10 minutes searching for information regarding the status of the order.

Collectively, this manual order workflow creates a “data black hole.” Orders are processed; however, intelligence is not captured. The company does not know what the customer was searching for, what they abandoned during the shopping process, or the customer’s actual potential frequency of reorder.

The Goal of Phase 1: Quantify these costs. Companies utilizing best-in-class systems for automation indicate a 21% decrease in cost-per-order, representing the goal of Phase 1.

Phase 2: The Tech Bridge (Myth-Busting Integration)

Organizations do not need to replace their existing infrastructure in order to implement a digital transformation. What organizations require is a means to connect their legacy back-end system with their modern front-end.

You don’t have to replace your current B2B infrastructure for modern B2B commerce – you have to link them together.

The Strategy: Using API (application programming interface) and middleware, organizations can synchronize their new digital platform with their legacy ERP without impacting the core business logic of the ERP. Organizations do not need to synchronize all fields contained within their database; rather, they need to synchronize only the critical transactional data necessary for a customer to self-service:

- Customer Information: Credit limits and shipping addresses.

- Product Data: Customer-specific catalogs and tiered contract pricing.

- Inventory: Real-time stock levels and backorder visibility.

By synchronizing this critical transactional data, organizations convert their legacy ERP into a real-time data source to fuel a 24/7 sales engine.

Phase 3: The Rollout (The 80/20 Adoption Rule)

One of the largest mistakes made in implementing digital transformation is attempting to implement a “big bang” rollout. Attempting to get 100% of all customers to purchase 100% of all products online immediately is generally unsuccessful.

The Blueprint uses the “Start Small” approach based on the Pareto Principle as described below.

- Identify the Top 20%: Identify the top 20% of your customers that produce the largest volume of repeat orders. Typically, these are your most loyal customers; however, these customers are also consuming the most time from your CSR team.

- Focus on Reorders, Not Complexity: Do not delay launching the digital platform trying to determine how to sell complex, engineered-to-order products online. Focus on the simple, high-volume products that consume the majority of your CSR time.

By migrating a subset of customers to a digital platform initially, you create an instant “flywheel effect.” You free up a large amount of CSR time, significantly reduce the likelihood of errors occurring with your most important customers, and generate the ROI needed to fund additional rollouts.

Phase 4: The Growth (Engineering AOV and CLTV)

The Final Phase focuses on shifting the emphasis from “Cost-to-serve” to “Revenue generation”.

A manual phone order is simply a transaction; a digital order is a revenue generating opportunity. Since a CSR may be too busy to adequately offer cross-sells when taking a manual phone order, a digital platform is a “24/7 salesperson” that never forgets to ask a customer if they want to add something else to their order.

Strategies to Increase Average Order Value (AOV):

- “Shop the Look” Logic: Use algorithms to automatically suggest related products like “Customers Who Bought This Pump Also Bought This” filter.

- Sticky Portals: When a customer has access to a customized portal containing their individualized “reorder list” and contracted pricing, they develop a psychological barrier to switch to another supplier. Switching to a competitor is considered a “high friction decision,” because you are losing all of your prior history with this product and the convenience of knowing how it will perform.

Real-World Validation: The Apex Case Study Consider the example of “Apex Building Supplies,” a regional distributor that applied this blueprint. Facing flat growth and a high-touch/high-cost model, they launched a portal focused on their top 100 contractor accounts.

The results within 18 months were transformative:

- 35% reduction in order processing errors.

- 60% of all reorders migrated to the digital platform, freeing up CSR time to focus on selling.

- 18% increase in AOV due to automatic cross-selling suggestions.

- 25% increase in sales productivity, measured by the number of new accounts opened, since CSR representatives are no longer spending time entering orders into the system.

Conclusion

Transitioning from manual to digital is not a matter of replacing old hardware with new hardware. Rather, transitioning from manual to digital is a fundamental change in business logic. You are transforming from a reactive business model that waits for the phone to ring and reacts to problems as they arise, to a proactive business model that uses data to drive growth.

By identifying your leaks, bridging your ERP, targeting your top 20%, and designing your platform to encourage cross-selling, you will eliminate the “silent killer” in your order book. You will replace the friction created by the “manual order labyrinth” with the precision of a “profit engine”.

Therefore, the question is no longer whether you should automate your order processing, but how quickly you can execute the digital reorder blueprint to protect your margins.

Aravind S., CFO of Ceymox, is a strategic finance leader with a sharp focus on operational excellence, sustainable scaling, and financial innovation within the digital commerce ecosystem. As a key pillar in Ceymox’s leadership, Aravind brings deep expertise in financial planning, risk management, costing, and performance optimization—ensuring the company’s growth remains efficient, stable, and future-ready.With extensive experience in managing financial systems for IT and eCommerce service organizations, Aravind plays a crucial role in transforming business operations into predictable, measurable, and scalable models. His approach blends analytical rigor with business foresight, enabling data-backed decision-making that accelerates growth and improves profitability.Beyond numbers, Aravind is passionate about strengthening financial governance, optimizing resource allocation, and building long-term value for clients, partners, and stakeholders. His strategic insights continue to guide Ceymox as it expands its presence in the global Magento and digital commerce space.

View All Articles